Client Downloads and Resources

Important Dates

1/31/2022- 1099-INT & 1099-NEC forms due

3/15/2022 - 1120S S Corporation, 1065 Partnership Returns due

4/18/2022 - 1040 Filings & Tax owed due, C Corporations due

9/15/2022- Extended 1120s and 1065 Returns due

10/15/2022- Extended 1040 returns due

Helpful Links

IRS - Pay your taxes Online - https://www.irs.gov/payments

IRS- Setup an Installment Plan- https://www.irs.gov/payments/online-payment-agreement-application

ShareFile Login - https://kolodijtaxandconsulting.sharefile.com

E-File 1099 Forms- https://www.efile4biz.com or https://www.track1099.com

Excel Organizers for Rentals and Business - Click to Download

In order to accurately prepare your taxes we will need a basic P&L for the year of income and expenses incurred. Please utilize the downloads below to organize your income and expenses related to your real estate activities- or use them as a guide to ensure your own spreadsheet includes everything needed.

Tax Form Guide

1098

Reports your total mortgage interest and real estate taxes paid for the year.

Please label as which property form goes to

Please note if for HELOC or REFI on document name.

1098-E

Reports any student loan interest you paid

1098-T

Reports any tuition paid for yourself or a dependent during the year.

1099-B

Reports stock sales during the year. Often you may received one large 1099 pack which includes 1099-B for stock sales, 1099-Div for dividends, and 1099-Int for interest.

1099-Div

Reports your dividends received

1099-Int

Reports interest income received

1099-Misc

This form may report several things. Most commonly rental income received, and Non employee compensation.

Ensure to still provide a full breakout of rents/expenses by property- as often this form will show a combined total of all rents a property manager received on your behalf.

1099-R

Reports distributions from a retirement account.

Review and ask your custodian for any questions if a distribution you believed to be a rollover is not classified as such based on the code in box 7.

1099-G

Reports payments received from the government. This is commonly seen for reported unemployment benefits.

This will also report a taxable state tax refund. If you itemize your taxes and deduct the state taxes paid as an itemized deduction- the state refund becomes taxable income the following year.

1099-S

This form reports a sale of real estate. Please ensure to upload if one is received even if it should be a non-taxable sale such as a sale of a primary home.

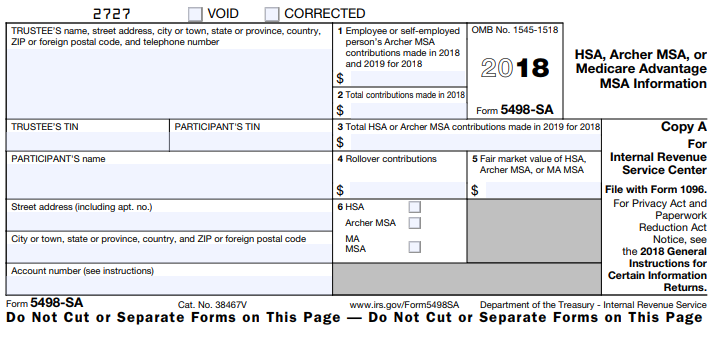

5498-SA

Reports your distributions from an HSA. If you received an HSA distribution please ensure your organizer reports that all distributions were used for qualifying medical expenses.

5498

Reports contributions to an IRA

Largely used for basis tracking in your IRAs but still required for tax filing

Child Care Report

If you paid for child care we will need a summary including:

The provider Name, Address, and Tax ID number

How much was paid per child

Charitable Contributions

If you donate cash to a qualified charity please upload the tax receipt received.

If you donated non-cash items to somewhere like a 2nd hand store you are often provided a receipt.

Please ensure you fill this out completely with:

The Name and Address of the store charity donated to

A date when they were donated.

A summary of what was donated.

And an estimated value of donated goods.

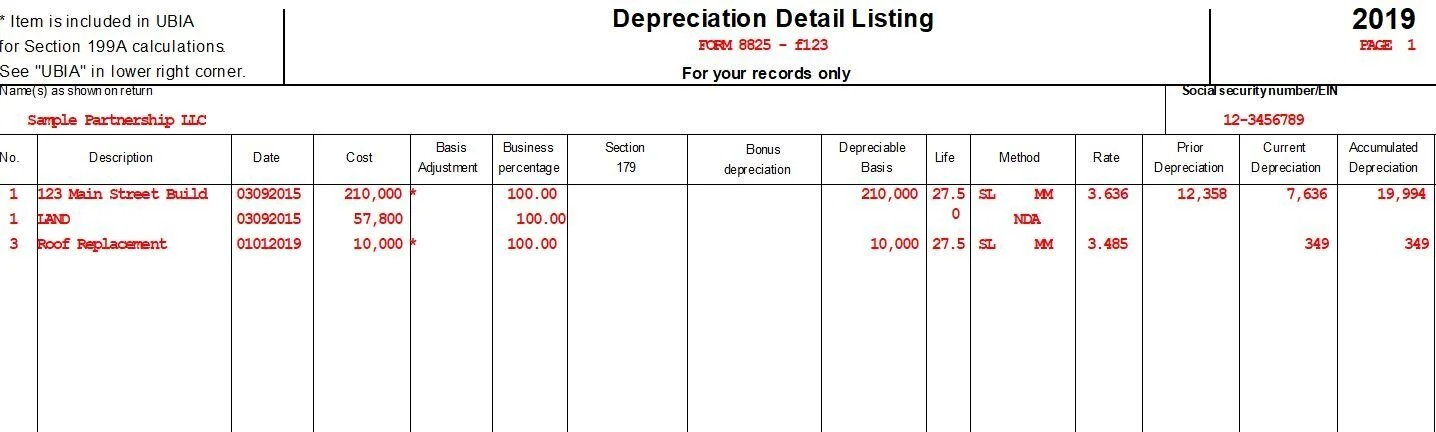

Depreciation Schedule

If you have existing rentals this schedule will be needed.

This is almost always a horizontal sheet in your tax packet- and your prior preparer may not have included it in your standard pack. It may need to be requested.

This schedule will list the asset, date in service, amounts used, prior depreciation, life of depreciation, ect.

HUD/ ALTA Statement

When you purchase or sell a document you almost always receive one of these documents.

Please ensure to upload this for any new properties acquired, or any properties sold during the year.

Do not include any expenses from this statement on your rental’s annual P&L.

If you refinance a property you will receive a similar document which may contain loan fees- please ensure to upload refinance statements as well.

EIN number

If you set up an LLC you hopefully applied for an EIN number from the IRS.

This is essentially your businesses’ version of a social security number.

Please ensure to upload any state LLC formation documents, and any IRS EIN issuance documents.